In everyday life, we often see a lack of financial literacy, as the Government of Canada reports that about half of Canadians lose sleep over financial worries—a problem stemming from limited early education about money. This raises the question: when should we start learning financial concepts?

I’ve always been driven by a desire to create meaningful change that will make an impact in my own community, and the importance of financial literacy became clear to me through observing my younger brother and his classmates in elementary school. Even at their age, I could see a noticeable gap between those who understood basic concepts like saving money and those who hadn’t had the opportunity to learn. I believe in the power of access to knowledge and resources to level the playing field.

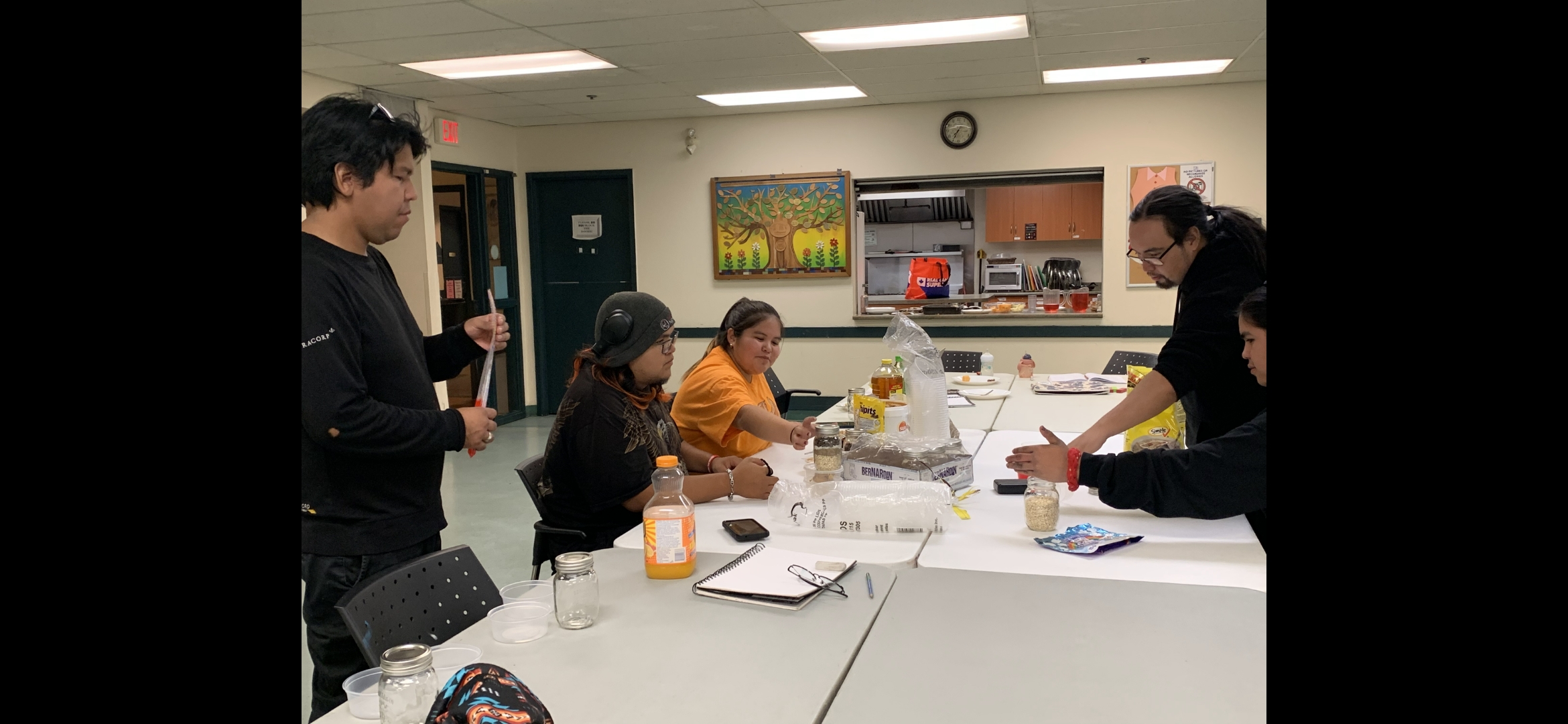

We live in an age where information is at our fingertips, but many people struggle to identify credible sources amid the noise of “fake news.” This inability to critically evaluate information can lead to harmful choices. The same principle applies to money—without a foundational understanding of financial literacy, people face unnecessary hardships later in life. To address this, I developed Cents & Sense, a financial literacy course for elementary students. Through engaging activities like teaching delayed gratification with candy or using apple trees to demonstrate interest, I equip students with knowledge and skills they can apply both now and in the future.

However, building Cents & Sense hasn’t been without its challenges. When I first began developing the curriculum, I quickly realized there was a lack of readily available resources tailored to younger audiences. This meant countless hours of research, diving into academic journals, financial education guides, and child psychology studies. I reached out to mentors, setting up meetings to ensure my course was not only comprehensive but also age-appropriate. The process required persistence and creativity, but I am grateful that I had a younger audience of family and friends to pitch my course lessons to before I brought it into classrooms.

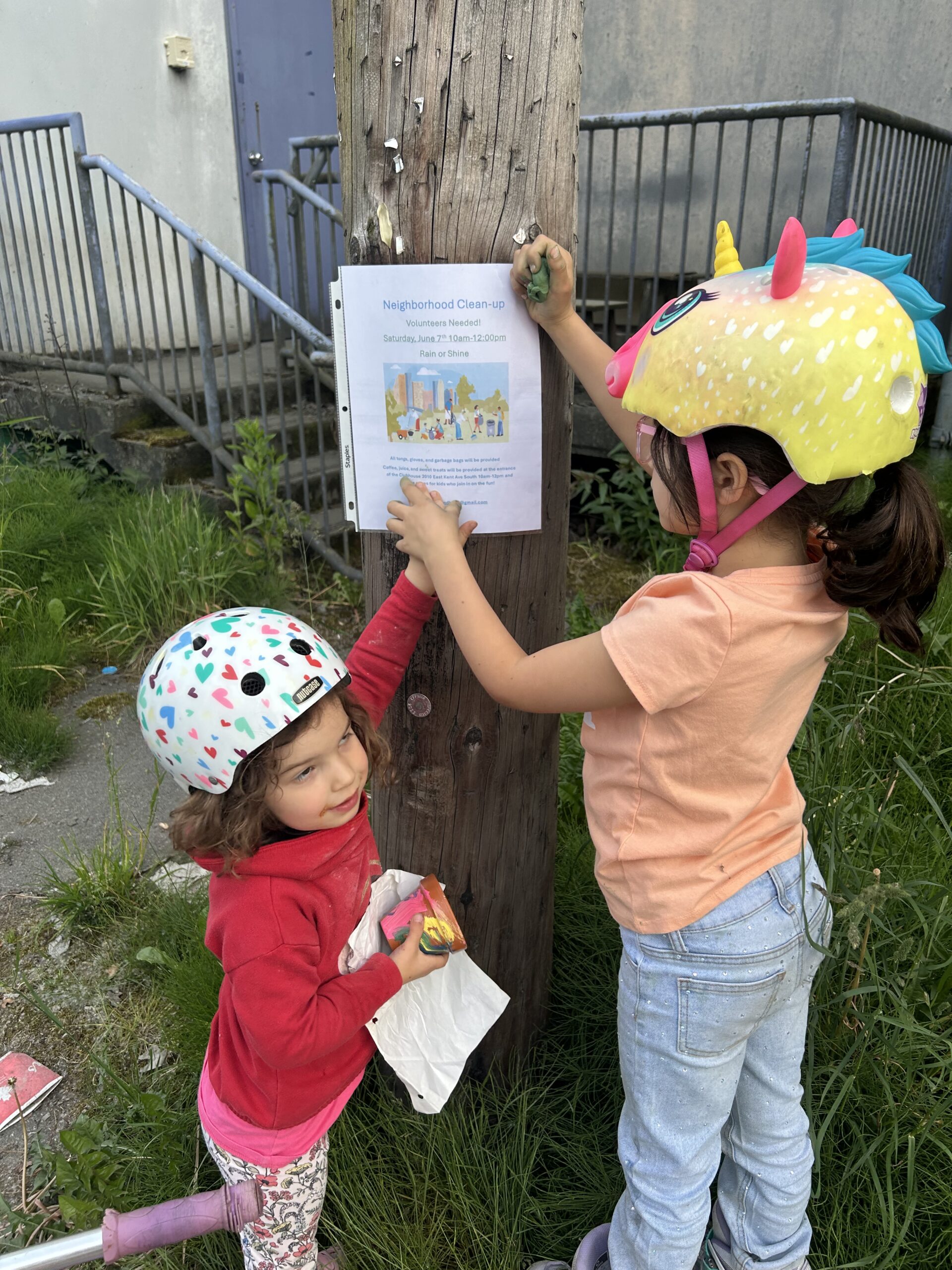

As I’ve worked with students, I’ve realized how varied their experiences with money are. Some describe open, comfortable conversations about it at home, but others say they’ve learned that it is rude to bring the topic up. The discrepancy in financial literacy begins long before kids even start school, perpetuating inequalities later in life. I hope my program can help close this gap and provide valuable tools to those who need them most. Whether it’s teaching students how to discern truth from misinformation or introducing them to foundational money concepts, the goal is the same: to empower the next generation to navigate the complexities of the world with confidence and skill.

Looking ahead, I aim to integrate financial literacy into the standard curriculum, making it a fundamental part of education rather than an optional or supplementary topic. This would ensure that families across all socioeconomic backgrounds have access to this essential knowledge. By embedding financial education into schools, we can create a ripple effect—one that not only benefits individual students but also their families and communities.